Global economy is managing much better during the COVID-19 pandemic than expected. One reason is that businesses are adapting to uncertainty and the new reality. Hybrid working models, teleconferences, digital back-office procedures, digital trade fairs, new business models – all this helped withstand the shock in most sectors, according to the Skanska and SpotData report on 100 trends defining the CEE economies in 2021.

“We are observing new trends and business transformations that are appearing on the market, which will shape the future. They create new opportunities and the new normal which will be our reality going forward. Together with the analytics company SpotData, we have listed them in the “100 trends in CEE economies” report. Our goal is to demonstrate their impact on CEE. After all those analyses and multiple discussions with different stakeholders, we are certain that CEE has a bright future and is a good place to invest, from the perspectives of both corporations and financial investors” said Katarzyna Zawodna-Bijoch, President and CEO at Skanska commercial development business unit in CEE.

As the "100 trends in CEE economies" report shows, Romania could be the country with the highest economic growth of all CEE region this year, despite the COVID-19 pandemic context. Showing great potential for work, perpetual development, and productivity, Romania remains a highly attractive market for investors, especially in the business, real estate, and IT areas. Furthermore, Romania shows openness to innovation and the implementation of new technologies” says Aurelia Luca, Executive Vice President for Operations in Hungary and Romania at Skanska in the EEC.

The paper shows the difficulties and perhaps opportunities of improving the region, even in the post-pandemic reality. The authors highlight the main trends that are going to drive further development of countries like Poland, Romania, the Czech Republic, and Hungary.

KEY CONCLUSIONS FROM THE REPORT:

- Most countries in the CEE region managed to avoid deep recessions and performed better than EU average in economic terms. The CEE region has a higher share of sectors that benefitted from the COVID-19 pandemic, and half the share of sectors that were severely hit – compared to the EU average. Long-term costs of the COVID-19 pandemic will be lower in CEE than the global average.

- The combination of very high qualified workers with relatively low levels of fixed capital per worker makes CEE a particularly attractive place to invest. Returns on investments are high for foreign companies, and host countries benefit from capital investments and transfers of knowledge related to new investments.

- One of the most important structural shifts ongoing in the CEE is an increase in demand for high-skilled workers. The share of office jobs is growing not only in services but also in industry - there is a gradual shift from manual work to white-collar work.

- Knowledge-intensive services, and particularly business services, are the fastest-growing segment of CEE economies. CEE has become one of the important global hubs for business services centers, which increasingly concentrate on the technology sectors. Highly educated workforce and availability of office space in large cities attracts many SSC/BPO investments to the region.

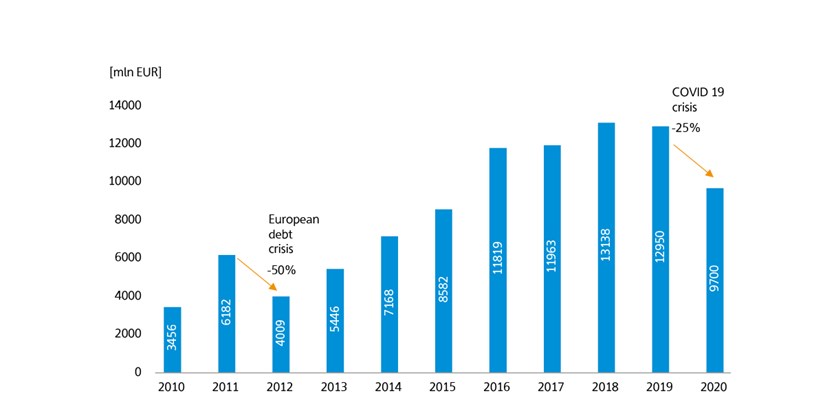

- Investor activity on the office market in CEE declined in 2020, but 2021 should bring back growth. The expected growth in remote and hybrid work will make investors seek higher-quality, core, well-performing assets, and locations.

- CEE has reduced emissions, but climate policy is still the biggest challenge for the region. All of the countries in the region manage to cut CO2 emissions per capita while growing their economies. Moreover, European Union plans to cut net greenhouse gas emissions by 55 percent (compared to the 1990 – the reference year) by 2030 and by 100 percent by 2050.

THE MAIN TRENDS IN ROMANIA:

- Romania could be the country with the fastest economic growth in 2021. Romania’s economy is expected to grow by 6% this year, after falling to 3.9% in 2020. Growth will be slightly lower in Poland at 4.1 %, as the economy was more resistant to the pandemic, registering a decrease of only 2.7%. Frontloaded use of NGEU grants will begin to support CEE economies this year and should provide a more substantial growth boost in 2022. Growth is projected to exceed 5% in Croatia, Hungary, Romania, and Slovakia next year and will be above 4.5% in Bulgaria, Czech Republic, Poland, and Slovenia.

- Romania, a particularly attractive market for the IT sector. The second-biggest market in the region is Romania, with 120,000 employed in business services as of 2018. The country is especially attractive for IT companies, partly because it offers generous tax incentives for specialists in this sector. Microsoft, Oracle, Deutsche Bank, and IBM are among the biggest occupiers of Romanian offices. Bucharest is the main city for business services, with more than 50% of the market, and almost two-thirds of the capital city’s outsourcing is in the ITO & BPO sector.

- Adapting to the pandemic context creates opportunities for development and innovation in Romania. The COVID-19 pandemic has created new needs and opportunities for technology use in real estate and given rise to innovation. Buildings will be smarter and there will be large-scale use PropTech applications and solutions.

- CEE has developed its digital capacities and is now well-placed to benefit from the global acceleration in digitalization. The biggest relative growth of programming was in Poland, where it accounted for 0.9% of gross value added in 2007 and 2.7% in 2018. Another software boom happened in Romania, increasing from 1.7% to 3.6% (the highest percentage in the region). This trend continued in 2019, where the figure rose to 4.2% (data for 2019 is not yet available for some countries). Both of those countries have tax incentives for IT development, such as a 5% income tax for self-employed developers in Poland (instead of 19%) and an exemption from payroll tax in Romania for selected IT jobs.

- Romania is the most successful country in the CEE Region and of all of Europe to cut CO2 emissions. All of the countries of CEE have managed to cut CO2 emissions per capita while expanding their economies. In total, the region cut its CO2 emissions by 30% compared with 1990 (the base year from which the EU intends to cut emissions by 55% by 2030). The most successful country in terms of this metric in the region, as well as all of Europe, was Romania, which cut CO2 emissions by 56% compared with 1990 while increasing its GDP per capita by 115%.

- Romania offers a quick solution to litigious civil and commercial cases. Romania stands out positively and is among the countries with the shortest estimated time needed to resolve litigious civil and commercial cases: the Czech Republic - 149 days, Hungary - 151 days, Slovakia 157 days, and Romania 157 days. Poland has the longest dispute resolution time, 273 days, but it is still shorter than in more developed countries such as France (420 days) and Italy (527 days).

- The potential disadvantages identified in Romania are the poorly developed transport infrastructure, the bureaucracy, and the lack of digitalization in the public administration sector. Despite joining the EU in 2007, has still not managed to substantially increase the quality of its transport infrastructure. The reason why Romania lags behind the other countries of CEE is mainly related to the problems with corruption and lack of transparency. However, things might change in the near future. There is growing pressure on the Romanian government to deal with the problem of neglected infrastructure. Public administration in both Poland and Romania lags behind in terms of digitization, but there are opportunities for rapid recovery in the next decade.

The report focuses on areas such as global and CEE perspective, society, education, work, companies and sectors, modern business services, digital transformation & technologies, and overall influence of the above, as well as the current state of the real estate market.

“The 100 Most Important Trends in the CEE economies” was created in cooperation with SpotData, an analytical center dealing with media, data visualization, and economic analysis.

The full version of the report can be found here: https://www.skanska.pl/en-us/100trends.